Understanding the Hard Market

The insurance industry is going through a ‘hard market.’ This means premiums go up. Coverage terms get more restricted. The capacity for most types of insurance goes down. Why does this happen? It’s part of a larger cycle. It’s influenced by economic trends and catastrophic events. In simple terms, insurance costs more and is harder to find during a hard market.

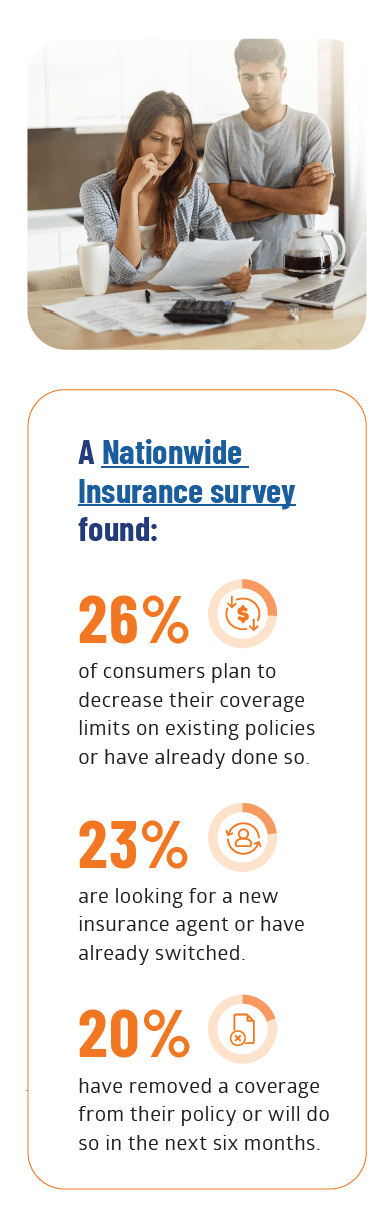

Impact on Customers

This tough environment is making businesses and individuals rethink their insurance coverage. As reported by IA Magazine, growing economic anxiety is leading some consumers to reduce their insurance coverage or even forego it altogether. But, cutting back on insurance might seem like a good short-term solution, but it could expose your business to significant risks in the long run.

The Importance of Preparation

So, how can you deal with these challenging conditions effectively? The key is preparation. In this market, timelines for renewing or changing your policy might be tight. It’s not uncommon for renewal quotes to arrive just two weeks before your policy’s expiration date. This reality emphasizes the need for constant communication with your insurance provider and being proactive in your preparation.

Understanding Your Coverage

Despite the short timeline, it’s still important to understand your current coverage, identify any gaps, and evaluate your business’s specific insurance needs. Your agent can use this information to find the best coverage options available in the market, despite its hardened state.

Stay Informed and Be Proactive

Remember, being proactive and staying informed are your best defenses in a hard market. We encourage you to reach out to your insurance provider, ask questions, and make sure you understand your coverage and the potential impacts of the hard market on your premiums and terms. Stay tuned for more information on how to navigate the hard insurance market, and don’t hesitate to reach out if you have questions or need assistance with your insurance needs.